Ophthalmic Device Market Overview, Size, Share, Trends, and Forecast Analysis Report By Product Type (Surgical, Vision Care), By End-user (Hospitals, Ophthalmic Clinics), By Region, And Segment Forecasts, 2025 –2030

Ophthalmic Device Market

The ophthalmic device market was valued at USD 53.11 billion in 2024 and is projected to grow at a CAGR of 4.50% from 2025 to 2030. The increasing prevalence of ocular diseases is a significant driver of this growth. For instance, cataracts affect approximately 94 million people, refractive errors impact 88.4 million, age-related macular degeneration (AMD) affects 8 million, glaucoma impacts 7.7 million, and diabetic retinopathy affects 3.9 million individuals Advancements in laser technology and intraocular lenses (IOLs) are enhancing treatment outcomes, leading to increased adoption of minimally invasive ophthalmic procedures. Growing awareness of eye health and government initiatives promoting preventive eye care programs are further boosting demand for diagnostic and vision care devices.

Drivers:

- Growing demand for refractive surgeries due to increasing cases of myopia and hyperopia

- Technological advancements in ophthalmic devices, including femtosecond lasers and AI-assisted diagnostics

- Increased adoption of minimally invasive surgical procedures for cataract and LASIK surgeries

- Rising use of artificial intelligence (AI) in ophthalmology for automated diagnostics and treatment planning

- Growing preference for contact lenses and spectacles due to prolonged screen exposure

- Government initiatives promoting preventive eye care and vision correction programs

- Increasing investment by private and public sectors in ophthalmic device R&D

- Expanding healthcare infrastructure and access to eye care services in developing regions

Restraints:

- High cost of advanced ophthalmic devices and surgical procedures

- Stringent regulatory requirements for ophthalmic device approvals

- Lack of access to ophthalmic care in remote and underserved regions

- Risk of post-surgical complications and device-related infections

Ophthalmic Device Market Size, 2024 (USD Billion)

The integration of artificial intelligence (AI) in ophthalmology is transforming diagnostics, disease management, and surgical planning, improving efficiency and accuracy in eye care. For instance, AI-powered retinal imaging tools have demonstrated over 90% accuracy in detecting diabetic retinopathy (DR), glaucoma, and age-related macular degeneration (AMD) at early stages, enabling timely intervention and reducing vision loss. With 34.6% of diabetes patients developing DR, AI-based screening has become essential in preventing blindness among working-age adults (20–74 years old). The global incidence of diabetes has tripled in the past two decades, increasing DR cases and driving demand for automated AI diagnostics. AI-assisted deep learning models integrated into optical coherence tomography (OCT) and fundus photography enhance early detection with greater precision. The growing adoption of AI-driven ophthalmic devices in eye hospitals and teleophthalmology services is expected to advance early disease detection and personalized treatments.

The increasing prevalence of myopia and hyperopia, coupled with rising awareness of permanent vision correction solutions, is driving demand for refractive surgeries such as LASIK, SMILE, and PRK. For instance, the World Health Organization (WHO) estimates that by 2050, nearly 50% of the global population will be affected by myopia, creating a strong demand for laser vision correction procedures. Advances in femtosecond laser technology and topography-guided LASIK have improved surgical precision and safety, leading to faster recovery times and higher success rates. The growing preference for spectacle-free vision among younger demographics and professionals, particularly in industries requiring high visual acuity, is further propelling the adoption of minimally invasive refractive surgeries. In addition, advancements in wavefront-guided and customized laser ablation techniques are offering personalized treatment options, enhancing patient outcomes and fueling market growth.

Ophthalmic Device Market Dynamics:

Opportunities:

The integration of AI-driven diagnostic devices is enhancing early detection of diabetic retinopathy, glaucoma, and macular degeneration, improving efficiency and accuracy in ophthalmic care. The demand for advanced intraocular lenses (IOLs) with superior visual correction is increasing due to the rising number of cataract surgeries. Robotic-assisted surgical systems are improving precision and reducing post-operative complications, making complex procedures more efficient. Teleophthalmology-enabled diagnostic devices are expanding eye care access in underserved regions, minimizing the need for in-person consultations. Strategic partnerships between medical device manufacturers and biotech firms are driving innovations in laser technologies.

Challenges:

The high cost of advanced ophthalmic devices, including femtosecond lasers and robotic surgical systems, limits accessibility in developing regions. Regulatory barriers and lengthy approval processes delay the introduction of new ophthalmic technologies, restricting market growth. The rise of AI-powered diagnostic tools presents challenges in clinical validation, liability concerns, and physician adoption. Cybersecurity risks and data privacy issues in connected ophthalmic devices necessitate stringent compliance with global regulations. Market saturation in developed regions is slowing growth, pushing companies to focus on affordability and expansion in emerging economies

Segmentation:

Product Type Insights and Trends:

The vision care segment dominated the market due to the widespread extensiveness of refractive errors and presbyopia. For instance, an estimated 50% of individuals over 50 years of age in developing regions struggle with unmanaged presbyopia due to limited awareness and accessibility to affordable treatment, while in developed countries, the commonness remains as high as 34%. The increasing demand for prescription glasses, contact lenses, and advanced spectacle lenses has solidified this segment’s dominance. The growing reliance on digital screens has further driven demand for blue-light-blocking lenses and anti-fatigue eyewear, enhancing consumer adoption. The ophthalmology landscape is also evolving with innovations in materials science, such as the use of nanoporous materials, which offer improved durability, moisture retention, and comfort in vision correction products.

The vision care segment is experiencing the fastest growth, driven by rising cases of myopia and hyperopia, along with an increasing preference for non-surgical vision correction solutions. For instance, the International Myopia Institute reported that one in three people worldwide currently has myopia, with projections indicating a significant increase in high myopia cases by 2050. This trend is fueling demand for contact lenses, orthokeratology (Ortho-K) lenses, and customized lens solutions. The expansion of daily disposable and silicone hydrogel lenses has improved convenience and comfort, leading to higher adoption rates. Advancements in smart contact lenses with biosensors for glucose monitoring and intraocular pressure tracking are further transforming the segment. Increasing disposable income and growing aesthetic preferences have also led to a rise in demand for colored and cosmetic contact lenses.

End-user Insights and Trends:

Ophthalmic clinics segment dominated the market, primarily due to the specialized care they offer for various eye conditions. These clinics are equipped with advanced diagnostic and surgical tools, enabling efficient management of ocular diseases. The increasing prevalence of eye disorders, such as cataracts and glaucoma, has led to a higher patient influx in these clinics. For instance, the Mayo Clinic’s Department of Ophthalmology provides more than 250,000 outpatient visits for eye care annually. The specialized nature of ophthalmic clinics, combined with their accessibility and focus on eye health, reinforces their dominance in the market.

Others segment is expected to experience significant growth, encompassing ambulatory surgical centers, academic and research institutes, and home care settings, is experiencing rapid growth in the ophthalmic devices market. This surge is driven by the decentralization of eye care services and the increasing adoption of portable and user-friendly ophthalmic devices. Ambulatory surgical centers, for instance, offer cost-effective surgical solutions, leading to their rising popularity. Academic and research institutes are investing in advanced ophthalmic equipment to support innovative research and training programs. In addition, the growing trend of home-based eye care, facilitated by telemedicine and home-use diagnostic tools, contributes to the rapid expansion.

Ophthalmic Device Market Share by End User, 2024 (%)

Regional Insights and Trends:

North America holds a dominant position in the ophthalmic devices market due to high healthcare expenditure, advanced medical infrastructure, and a growing prevalence of vision-related disorders. For instance, U.S. alone conducts over 4 million cataract surgeries annually, driving demand for intraocular lenses (IOLs), phacoemulsification devices, and femtosecond lasers. The increasing adoption of AI-driven diagnostic systems and robotic-assisted ophthalmic surgeries is further transforming the industry. Government initiatives such as Medicare coverage for essential ophthalmic procedures are improving accessibility, while the presence of key industry players, including Alcon and Johnson & Johnson Vision, is accelerating product innovation.

U.S. Ophthalmic Devices Market Insights and Trends:

U.S. dominated the North America ophthalmic devices market, it is expanding due to rising cases of age-related macular degeneration (AMD), diabetic retinopathy, and glaucoma. For instance, the American Academy of Ophthalmology (AAO) reports that over 24 million Americans aged 40 and older have cataracts, increasing demand for vision correction solutions. The country is witnessing higher adoption of teleophthalmology services, improving accessibility for patients in remote areas. The U.S. Food and Drug Administration (FDA) continues to approve advanced IOLs, AI-powered imaging systems, and innovative laser technologies, positioning the country as a leader in ophthalmic device innovation.

Europe Ophthalmic Devices Market Insights and Trends:

The ophthalmic devices market in Europe is expanding due to government-led vision care programs, rising adoption of minimally invasive surgeries, and advancements in biosimilar ophthalmic treatments. Countries such as Germany, France, and the UK are driving growth, supported by enhanced reimbursement policies and AI-integrated diagnostic tools improving early disease detection. The aging population has led to a higher incidence of cataracts, glaucoma, and AMD, increasing demand for advanced surgical and diagnostic devices. Optometry and optics vary across EU nations, influencing the distribution and adoption of ophthalmic devices. For instance, France employs the most opticians (5.55 per 10,000 people), while Cyprus has the highest number of retail outlets (2.69 per 10,000 people). In Spain and Nordic countries, optometry and optics are combined, leading to higher numbers of optometrists.

UK Ophthalmic Devices Market Insights and Trends:

The ophthalmic devices market in UK benefits from a robust research environment, an expanding network of vision care clinics, and strong public-private healthcare collaborations. The National Health Service (NHS) has implemented comprehensive screening programs targeting diabetic retinopathy, glaucoma, and age-related macular degeneration (AMD), ensuring early diagnosis and effective management. The increasing adoption of wearable vision correction technologies and AI-assisted screening solutions is enhancing patient outcomes. Research hubs in Cambridge and London are at the forefront of innovations in ophthalmic imaging, drug delivery implants, and robotic-assisted surgeries, contributing to the market’s dynamic growth.

Asia-Pacific Ophthalmic Devices Market Insights and Trends:

The Asia-Pacific region is witnessing rapid growth in the ophthalmic devices market, driven by an aging population, increasing demand for vision correction solutions, and improved healthcare access. Countries such as China, Japan, and India are heavily investing in ophthalmic research and AI-based diagnostics, services to enhance eye care accessibility. The prevalence of diabetic retinopathy and cataracts is rising, increasing the demand for advanced diagnostic imaging systems and minimally invasive surgical procedures. For instance, in India, over 6.5 million cataract surgeries are performed annually, making it one of the largest markets for intraocular lenses and phacoemulsification systems.

China Ophthalmic Devices Market Insights and Trends:

The ophthalmic devices market in China is expanding due to government-backed healthcare reforms, a rise in cataract surgeries, and the emergence of local ophthalmic manufacturers. The National Medical Products Administration (NMPA) has streamlined approvals for biocompatible intraocular lenses and AI-powered retinal screening systems, enhancing access to advanced eye care. Local companies, such as WuXi AppTec and MicroPort Scientific, are investing in next-generation ophthalmic implants and robotic surgical solutions, positioning China as a significant player in the global ophthalmic devices market

Latin America Ophthalmic Devices Market Insights and Trends:

The ophthalmic devices market in Latin America is expanding due to increased awareness of preventable blindness, heightened government investments in eye care, and a growing demand for vision correction solutions. Countries such as Brazil, Mexico, and Argentina are at the forefront of this growth, with a notable rise in cataract and LASIK procedures. The Pan American Health Organization (PAHO) collaborates with governments to eliminate avoidable blindness through national vision care programs, further supporting the adoption of ophthalmic devices in the region. Economic development and improved healthcare infrastructure are making advanced eye care services more accessible to the population

Brazil Ophthalmic Devices Market Insights and Trends:

The ophthalmic devices market in Brazil is witnessing rapid growth, bolstered by government-funded vision care initiatives and a robust private healthcare sector. For instance, the country has seen a significant increase in cataract surgeries, with 663,186 procedures performed in 2019, up from 228,145 in 2000. This growth is attributed to greater public investments and improved healthcare infrastructure. The rise in corporate partnerships between local manufacturers and international ophthalmic firms is further driving innovation and accessibility in the sector. The Brazilian government’s commitment to reducing surgical wait times has improved patient access to necessary eye surgeries.

Middle East & Africa Ophthalmic Devices Market Insights and Trends:

The ophthalmic devices market in Middle East & Africa (MEA) is growing due to rising incidences of cataracts and glaucoma, increasing medical tourism, and government efforts to improve vision care accessibility. Countries such as Saudi Arabia, the UAE, and South Africa are investing in ophthalmic clinics, teleophthalmology services, and AI-powered screening programs. For instance, World Health Organization (WHO) and the International Agency for the Prevention of Blindness (IAPB) are collaborating with governments to reduce vision impairment rates through strategic initiatives. Saudi Arabia, as part of its Vision 2030 healthcare strategy, has increased funding for retinal screening programs, AI-based diagnostic platforms, and state-of-the-art ophthalmic surgical centers

Recent Development:

- In December 2024, Bausch & Lomb Corporation announced that an affiliate acquired Elios Vision, Inc., developer of the ELIOS procedure, the first clinically validated, minimally invasive glaucoma surgery (MIGS) procedure using an excimer laser. The acquisition unlocks new opportunities to treat glaucoma effectively in conjunction with cataract surgery without implants and bolsters Bausch + Lomb’s glaucoma portfolio.

- In September 2024, Johnson & Johnson Vision expanded the rollout of TECNIS Odyssey, its latest presbyopia-correcting intraocular lens (PC-IOL), in the U.S. market. Built on the TECNIS platform, the TECNIS Odyssey IOL provides two times better contrast in low-light conditions compared to PanOptix IOLs. The full visual range IOL is designed to offer continuous vision from far to near, minimizing the need for glasses and improving overall patient satisfaction.

List of Key Companies Profiled:

- Carl Zeiss Meditec AG

- Bausch & Lomb Incorporated

- Johnson & Johnson Vision Care

- Alcon Vision LLC

- TOPCON Corporation

- Essilor International S.A

- Ziemer Ophthalmic Systems Ltd

- Nidek Co. Ltd

- Haag-Streit Group

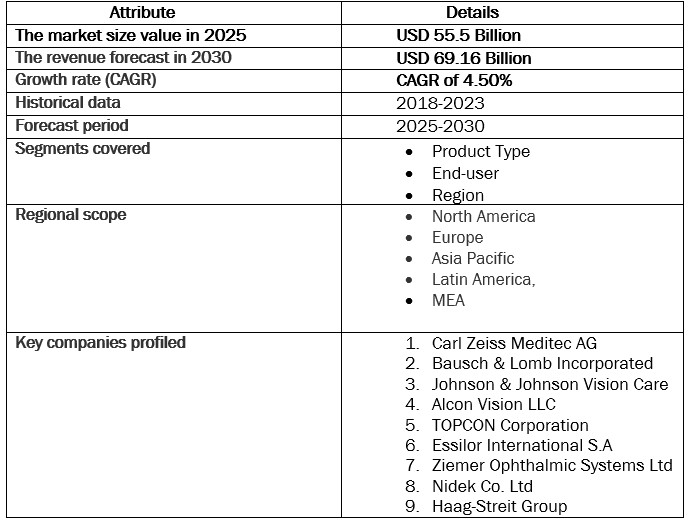

Ophthalmic Device Market Report Scope

Ophthalmic Devices Market Report Segmentation:

This report forecasts revenue growth on a global, regional, and country level and analyzes the latest trends across various sub-segments from 2018 to 2030. Driven Market Research Pvt. Ltd. has segmented the ophthalmic devices market report by product type, end-user, and region:

Product Type Outlook:

- Surgical

- Vision Care

End-user Outlook:

- Hospitals

- Ophthalmic Clinics

- Others

Region Outlook: